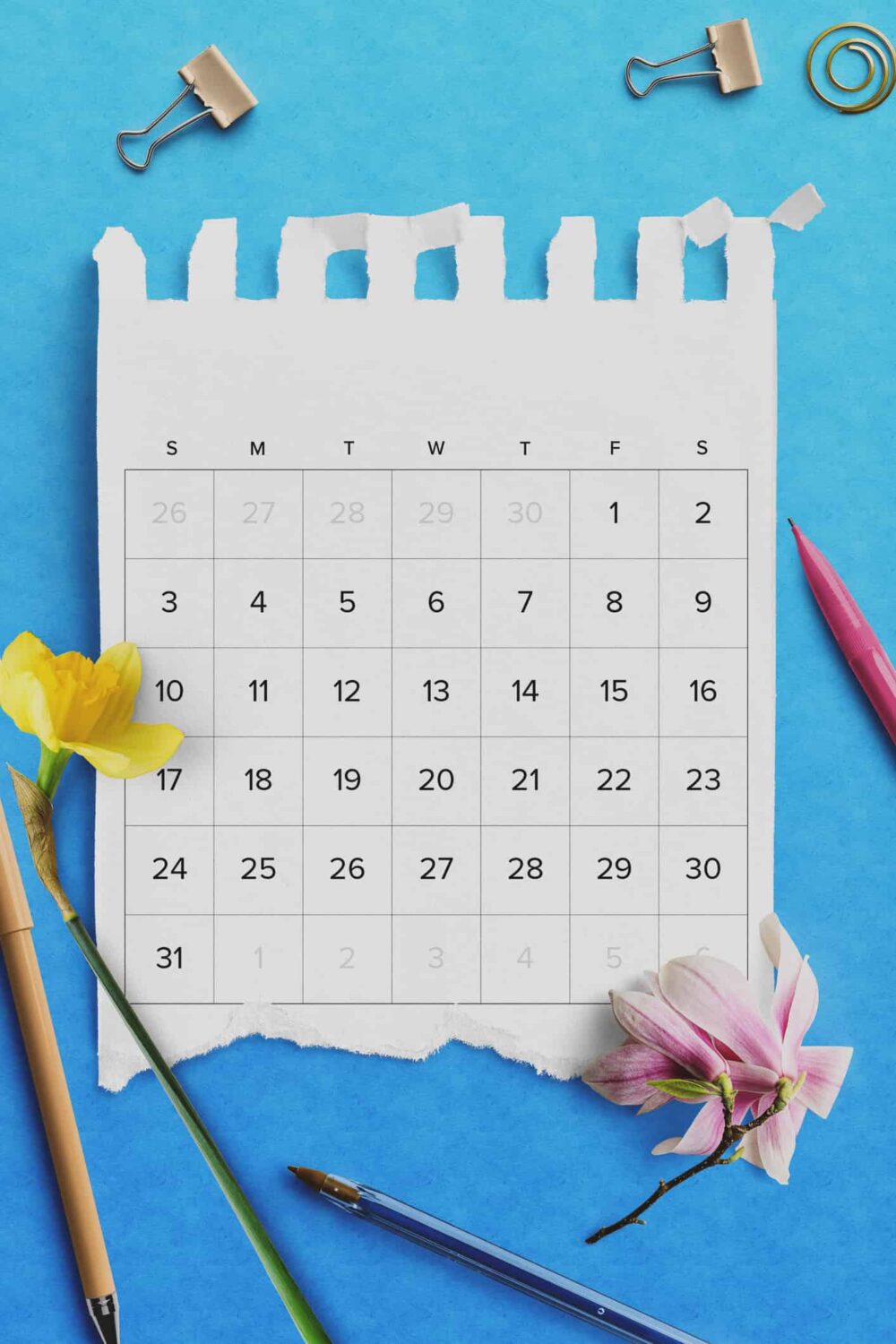

The primary Spanish tax deadlines are 30 June for resident annual income tax (IRPF) and 31 December for non-resident imputed income tax, filed using the Modelo 210. Landlords must submit rental income taxes quarterly (Jan 20, Apr 20, Jul 20, Oct 20) to ensure full compliance and avoid penalties.

Continue readingSpanish Property Tax

Spanish Rental Income Tax (Modelo 210) Update 2024: Quarterly vs. Annual Filing

The primary change to Spanish rental income tax now permits non-resident property owners to file their tax returns (Modelo 210) annually instead of being subject to the former quarterly filing requirement. This new annual deadline for rental income earned from 2024 onward falls on January 20 of the following year, though all income earned prior to 2024 must still be filed quarterly.

Continue reading →Spanish Property Tax for Non-Residents: Your Essential Guide

Managing Spanish tax on rental income? Here’s everything you need to know about Spanish property tax for non-residents.

Continue reading →Spain’s Deemed Annual Tax (Modelo 210): A 2025 Guide for Non-Resident Landlords

If you own a home in Spain that isn’t your main residence, you may owe an additional charge known as the Deemed Annual Tax (Modelo 210). This tax applies even if you don’t rent your property, and missing it can lead to penalties or fines.

Continue reading →What are deemed tax returns for a property in Spain?

If you own a property in Spain but don’t rent it out, you’re still required to pay tax on its deemed rental value. This often-overlooked “deemed income tax” (Modelo 210) catches many non-resident landlords by surprise — and failing to file it can lead to penalties from the Spanish tax authority.

Continue reading →What is the history behind PTI Returns? Q&A from our tax team.

When was “Property Tax International” created?

The idea was born in 2006.

We noticed that more and more people were purchasing property abroad and there was a gap in the market for a company that could organise and manage the tax requirements of international property owners.

We wanted to help people who have a property and rental income in France, Germany, Spain, Ireland, the UK, Poland, Hungary and the USA to meet their tax obligations.

Is Spanish rental income taxable in the UK?

Thinking about renting out your Spanish property and wondering if Spanish rental income is taxable in the UK?

You’re not alone. Navigating international tax rules can be confusing.

This quick guide breaks down whether your Spanish rental income is taxable in the UK, helping you understand the essentials and stay on the right side of the law. Let’s make sense of it together!

What’s the Spanish NIE number? And what is it needed for?

Are you a non-resident planning to live, work, or own property in Spain? Are you wondering if you need to pay rental income tax in Spain? Then you’ll need to get familiar with the Spanish NIE number – a crucial identification document that all foreign residents in Spain must have.

But what exactly is the Spanish NIE number, and why is it so important?

In this article, we’ll take a deep dive into the world of the NIE number and explore everything you need to know, from what it is and how to get it, to why it’s essential for opening a bank account, buying property, getting a job, and much more.

Everything you need to know about mortgages in Spain for non-residents

Ready to own a piece of paradise in Spain? More and more foreigners are purchasing properties in Spain. According to information from Spain’s General Council of Notaries, over 67,983 houses were bought by foreigners in 2023, making up around 13% of all transactions. Additionally, foreign citizens signed 7% of the mortgages issued in Spain for property purchases. Luckily, getting a Spanish mortgage for non-residents is possible, and there are various options available. This could be the golden ticket you need to unlock the doors to the country’s coveted housing market. Buying property in Spain, such as a holiday home, and getting a Spanish mortgage for non-residents might be difficult but not impossible. While some Spanish banks may turn a blind eye to those living and paying taxes abroad, don’t fret! There are plenty of other banks that are more than happy to give mortgages to foreigners so that they can make their Spanish dream a reality. Here is everything you need to know about mortgages in Spain for non-residents.

Please note: PTI Returns provides property tax return filing services to Spanish property investors. Unfortunately, we do not offer support services related to mortgage applications or Spanish property purchases.

Selling property in Spain as a UK resident

If you are a UK resident selling property in Spain, the allure of the market is often balanced by the need to navigate a complex web of tax rules and legal obligations.

Spain’s vibrant culture, stunning landscapes, and favorable climate make it an attractive destination for foreigners looking to buy or sell property.

If you’ve bought property in Spain as an investment, or spotted a promising selling opportunity in the market, there are several factors to weigh before selling as a non-resident.

We’ve compiled the following guide to provide you with all the essential information needed to make informed decisions if you are a UK resident selling property in Spain, ensuring you save on costs and minimize potential risks.

Please note: PTI Returns supports international investors with Spanish property tax filing services. Unfortunately, we do not offer services related to Spanish mortgages or the sale of property in Spain.