Last Updated on November 13, 2025

Managing Spanish tax on rental income? Here’s everything you need to know about Spanish property tax for non-residents.

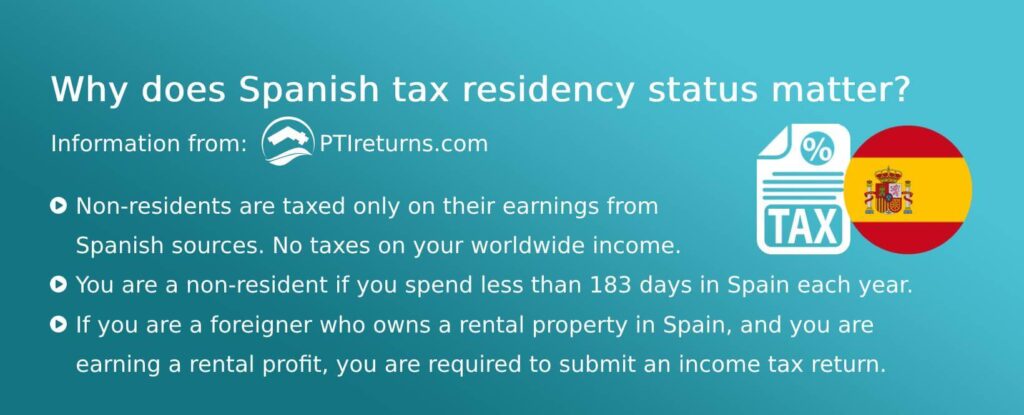

Your Non-Resident Tax Obligation

Did you know that if you are a foreigner and you own property in Spain but don’t live there, you might be on the hook for something called “non-resident tax in Spain”?

If you rent out your property, you mustpay rental income tax in Spain. Surprisingly, many property owners are unaware of their tax obligations and go years without paying them. However, things have changed recently, and understanding the nuances of international property tax is crucial for global real estate investors.

The tax authorities have become more active in pursuing unpaid non-resident taxes in Spain. They’re now sending out tax demands to those who haven’t paid their dues for the past four years.

Please note: PTI Returns provides tax return filing services to investors with property in Spain. We do not provide support services for mortgage applications or Spanish property purchases.

1. Non-Resident Income Tax (IRNR) & Compliance

Defining Residency and Registration

-

What makes you either a resident or a non-resident in Spain? You are a non-resident in Spain if you live in the country for less than 183 days in a single year. Non-residents pay taxes on any income from Spanish sources, while residents pay taxes on their worldwide income.

-

Should you be registered for Spanish tax to submit returns? When you purchased your property you were likely assigned a foreigner’s ID number (NIE). In most cases, property owners will already be registered for tax.

Tax on Rental Income

-

Do non-residents pay Spanish tax on rental income? Yes, non-resident property owners in Spain are typically subject to Non-Resident Income Tax (Impuesto sobre la Renta de No Residentes) on their rental income.

-

Tax Rates:

-

19% (for residents in the EU, Norway, and Iceland), after subtracting deductible expenses.

-

24% (for non-residents outside the EU, including the UK), with no allowable deductions.

-

-

Example: If the annual net rental income is 20,000 Euros and tax is 19% = 3,800 Euro.

-

What is Form 210? Form 210 is a Spanish tax form used by non-residents who obtain income from sources within Spain.

Tax on Unrented Property (Deemed/Imputed Tax)

-

How much Spanish income tax do I owe if I do not rent out my property in Spain? Foreigners may not be aware that they must pay non-resident income tax in Spain even if they do not rent out their property. This tax is called Impuesto de la renta de no residentes, declaración ordinaria (IRNR), or Deemed tax (Imputed tax).

-

When you must pay: You will have to pay this tax if you:

-

don’t live in Spain,

-

have an urban Spanish property,

-

don’t rent out this real estate, it’s exclusively for personal use, and

-

don’t have any other taxable income in Spain.

-

-

Calculation: Imputed income is 1.1% of the cadastral value (valor catastral) or 2% if no re-valuation has occurred in the previous ten taxable periods. The non-resident tax rates (19% or 24%) are applied to this imputed income.

Filing Deadlines

-

Rental Income Filing (2024 Update): Starting in 2024, you must report your rental income once a year instead of quarterly. For income earned in 2024, you will have to submit your tax return between January 1 and January 20, 2025.

-

Deemed Tax Filing (Unrented): If you do not have rental income, only one annual deemed tax return has to be submitted. The deadline is December 31 following the end of each tax year.

-

Note: If the real estate is rented for 200 days, for example, a deemed tax return must be filed for the rest of 165 days in addition to the quarterly rental property income tax returns.

Penalties and Joint Ownership

-

What should I do if I receive a claim for non-resident income tax in Spain? You should act fast to prevent further fines related to Spanish non-resident income tax. You will have to complete and file the Spanish income tax returns and make a payment of the tax due within the time frame given in the claim.

-

Missed Deadline Penalties: If you miss a filing and payment deadline, you may incur fines or penalties:

| Late Payment Period | Penalty/Surcharge |

|---|---|

| Up to 3 months | 5% |

| Up to 6 months | 10% |

| Up to 12 months | 15% |

-

Joint Ownership: Yes, each joint owner of the property is required to submit a separate return.

2. Deductions and Tax Relief

Benefit from EU/EEA Status

-

How do I benefit from my EU/EEA status? If you are a resident of an EU country or Norway and Iceland, you can deduct expenses and include depreciation to minimize your tax liability. You simply need to provide a Residency Certificate from the local Tax Authorities.

-

Residency Certificate: This is a document issued by the appropriate tax authorities of the country of residence, confirming your tax residency.

Allowable Expenses (For EU/EEA Residents)

-

What deductions can be made to reduce my tax liability? EU citizens are entitled to deduct expenses from their net income. Examples of Spanish property tax allowable expenses:

-

Mortgage Interest (excluding capital element)

-

Bank charges, Management fees, Letting agent fees

-

Local rates (IBI local tax, Waste local tax)

-

Insurance, Running costs (electricity, gas, water, internet, etc.)

-

Maintenance, Repairs

-

Building and Furniture depreciation /Capital allowances/

-

3. Other Spanish Property Taxes

Local Property Tax (Impuesto sobre Bienes Inmuebles – IBI)

-

What is the property tax IBI in Spain? This is a local tax in Spain imposed by the municipality.

-

Rates: The tax rate varies between 0.4% and 1.1% for urban properties. The tax varies but usually is between 200 and 800 Euro per year.

-

Regional Variation: Yes, the tax rates of the local Spanish property taxes vary from region to region due to the local governments.

Plusvalia Tax

-

What is the Plusvalia tax? The Plusvalia tax in Spain is a local tax charged by the Town Hall on properties, at the moment they are sold. It is calculated on the rateable value and depends on the number of years that have passed since the property last changed owners.

Capital Gains Tax (CGT)

-

How much is Capital Gains Tax in Spain? When you sell Spanish real estate, you owe Capital Gains Tax. CGT in Spain is 19% for non-residents from EU and EEA countries and 24% for non-residents from other countries including the UK.

Wealth Tax (Impuesto de Patrimonio)

-

What is the Spanish Wealth Tax? This is an individual tax on assets that both residents and non-residents must pay.

-

Threshold: If you are a non-resident, you will only be taxed on assets within the country, worth more than 700.000 Euros.

-

Rates: The wealth tax ranges between 0.2% and 3.5%.

4. Double Taxation Agreements (DTAs)

Which countries have double taxation agreements with Spain?

Spain signed double taxation agreements with the following countries:

-

Albania, Algeria, Andorra, Argentina, Armenia, Barbados, Australia, Austria, Cyprus, Belgium, Bolivia, Bosnia, Brazil, Bulgaria, Canada, Chile, China, Columbia, Costa Rica, Croatia, Cuba, Cyprus, Czech Republic, Dominican Republic, East Timor, Germany, Denmark, Kyrgyzstan, Ecuador, Egypt, El Salvador, Estonia, Finland, Romania, France, Georgia, Greece, Hungary, Iceland, India, Indonesia, Iran, Ireland, Israel, Italy, Japan, Kazakhstan, Korea, Latvia, Lithuania and Luxembourg.

-

Spain also signed treaties for the avoidance of double taxation with: Macedonia, Malaysia, Malta, New Zealand, Mexico, Moldova, Morocco, the Netherlands, Norway, Pakistan, Panama, Philippines, Poland, Portugal, Russia, Saudi Arabia, Serbia, Slovakia, Slovenia, South Africa, Sweden, Switzerland, Tajikistan, Thailand, Trinidad & Tobago, Tunisia, Turkey, Turkmenistan, United Arab Emirates, United Kingdom, USA, Uruguay, Uzbekistan, Venezuela and Vietnam.

5. Tax Assistance with PTI Returns (Advertisement)

Who can help me prepare my Spanish property tax return?

We know that the Spanish tax on rental income can be overwhelming, especially for non-residents! But help is at hand! Property Tax International (PTI Returns) will assist you with the entire process of preparation of tax forms in respect of Spanish tax on rental income.

Why PTI Returns is better than a local accountant:

-

Tax specialists – We know Spanish property tax! We guarantee to properly determine your residency status and apply every tax relief you’re entitled to.

-

No language barrier – we speak our client’s language and communicate with the local tax authorities on their behalf.

-

One-stop shop – need to file tax documents in more than one jurisdiction? You can do it all online with PTI Returns!

-

Better value – we offer a more affordable service than your local accountant.

Information We Need to Prepare Your Tax Returns

To prepare your Spanish property tax return we will need:

-

NIE of each owner.

-

The full address of the property, the date, and cost of purchase.

-

The cadastral value (valor catastral).

-

Personal details for each owner (Name, nationality, date/place of birth, current home address).

-

If you have rental property income, a schedule of the income and expenditure for the quarter.

-

The IBAN of your Spanish bank account.

Frequently Asked Questions (FAQ)

Q1: Does the Spanish tax year follow the calendar year?

A: Yes. The Spanish tax year runs from January 1st to December 31st, which is the basis for all annual tax calculations (rental income, imputed income, and Wealth Tax).

Q2: I live outside the EU and the UK. Can I pay the tax in my home currency?

A: No. All Spanish property tax liabilities, including those declared on Form 210, must be paid in Euros (€). This payment is typically made via direct debit from a Spanish bank account or a bank transfer/debit from a foreign (SEPA) account.

Q3: If I rent my property for only a few weeks, do I have to file two separate tax returns (Rental and Deemed)?

A: Yes, you must file two separate returns.

-

One Rental Income return (Form 210, income type 01) for the specific days the property was rented.

-

One Deemed Income return (Form 210, income type 02) for the remaining days of the year when the property was available for personal use and not rented.

Want to learn about our tax return filing service?

When you apply through this contact form a PTI Returns tax specialist will contact you.

Read also:

UK Resident selling property in Spain – Everything you need to know

Guide to rental income tax in Germany

Foreign rental income tax – A guide for American investors with overseas property